Contributing to Super

Contributing to superannuation can be done in several ways. However, you need to take care that you do not breach any contribution caps or limits. (Contribution Caps for 2021/2022)

Most superannuation funds or platforms have bPay and Direct Credit banking systems, so you can make contributions quickly and easily. With the introduction of

SuperStream, employer contributions also reach your superannuation fund more quickly.

(Note that an employer only needs to make superannuation contributions every quarter, regardless of how frequently you get paid.)

SG "Superannuation Guarantee" Contribution (work)

This is the government-mandated contribution your employer must make (with some minor exceptions). As at 1/7/2023 this is 11% and it is currently planned to increase to 12%.

Award/Other Contribution (work)

Some employment arrangements include extra employer contributions that are above the normal SG Contribution for the contract or award. In addition, some employment contracts match contributions. For example, if you add an extra 5%, the employer adds a bonus 2.5%.

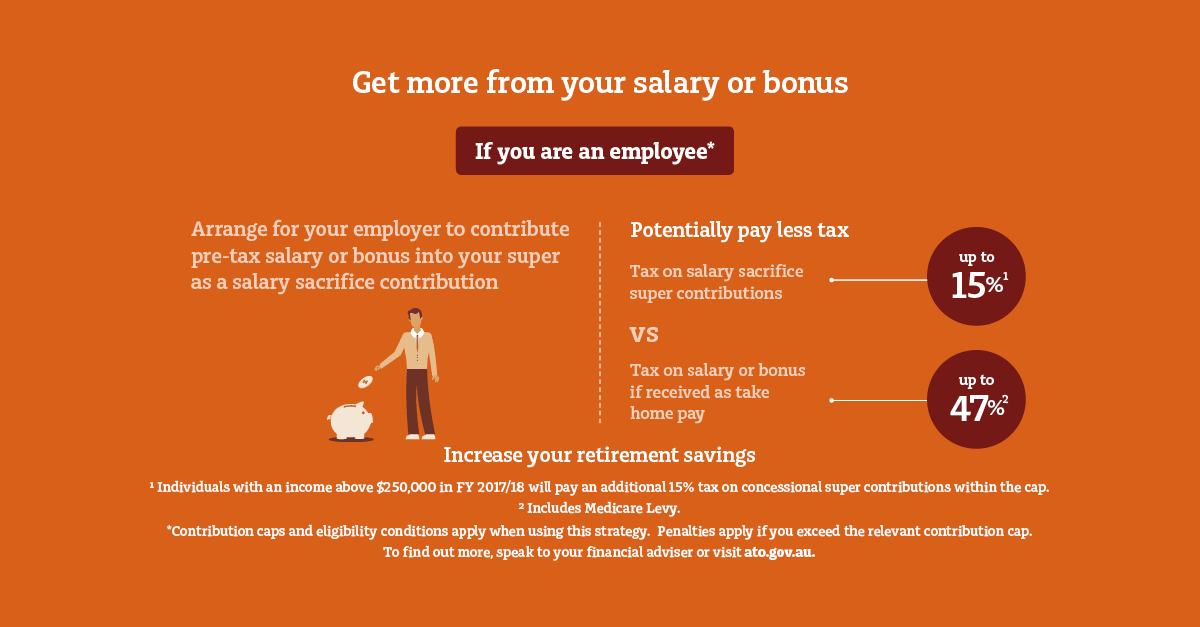

Salary Sacrifice (work)

Some employers offer staff the ability to salary package items, including superannuation contributions. Basically, your employer takes extra superannuation contributions from your wage before tax, potentially saving you money and building your superannuation balance much faster.

provided by MLC 201806 (click to enlarge)

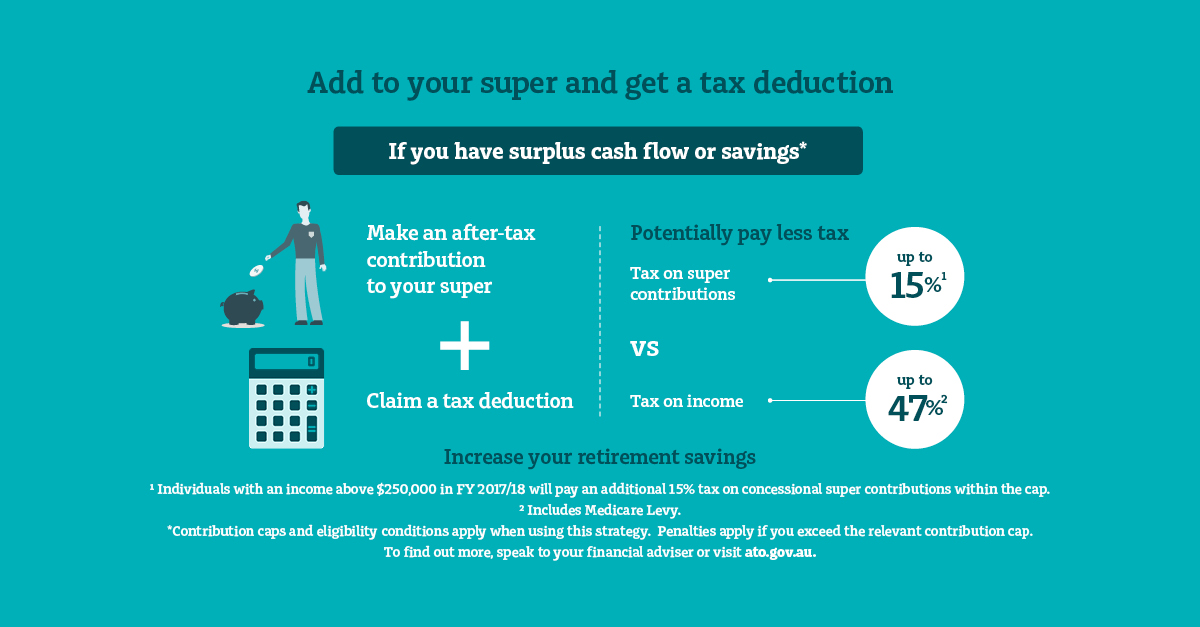

Personal Contribution - Deductable

This is when you make cash contributions from your own funds, then claim it as a tax deduction for the financial year. This method was once reserved

for self employed and those who satisfied the 10% test, but it has since expanded to include employees.

provided by MLC 201806 (click to enlarge)

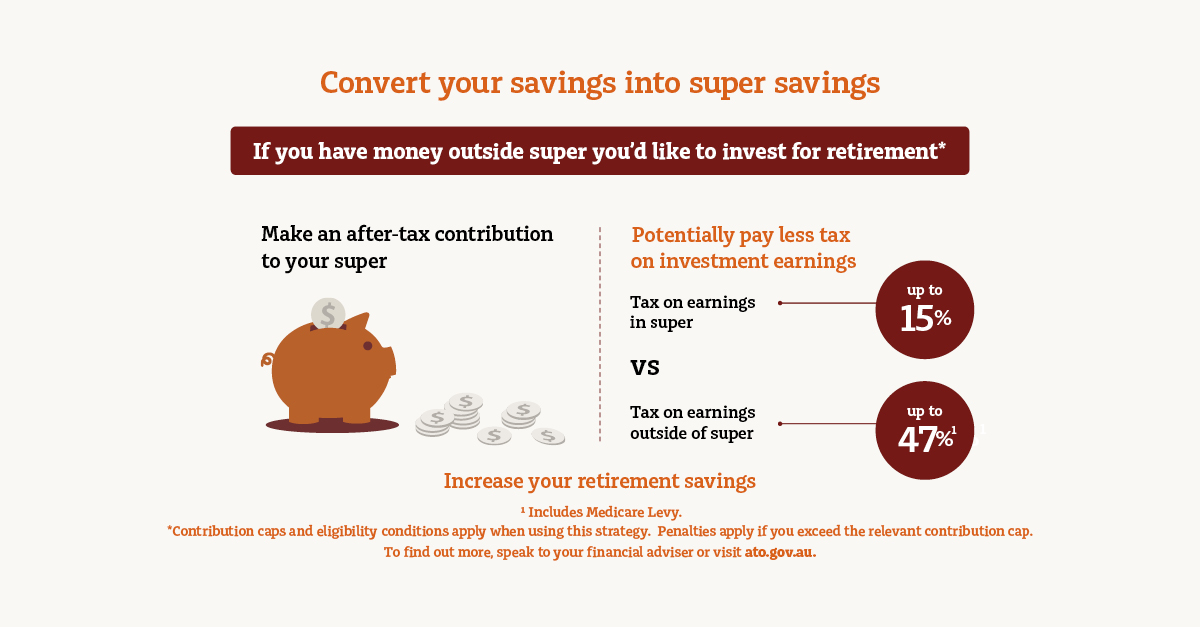

Personal Contribution - Undeducted

This is when you make cash contributions from your own funds after income tax has already been paid, and no deduction is claimed.

provided by MLC 201806 (click to enlarge)

Spouse Contribution

Sometimes, a spouse can contribute to your superannuation fund and they might be able to claim a tax deduction.

provided by MLC 201806 (click to enlarge)

Co-Contribution

Sometimes, you can make personal contributions, then, at the end of each year, the government will add to or match this contribution. This free contrbution is rare, but it still exists.

provided by MLC 201806 (click to enlarge)