Federal Budget Centrelink Changes

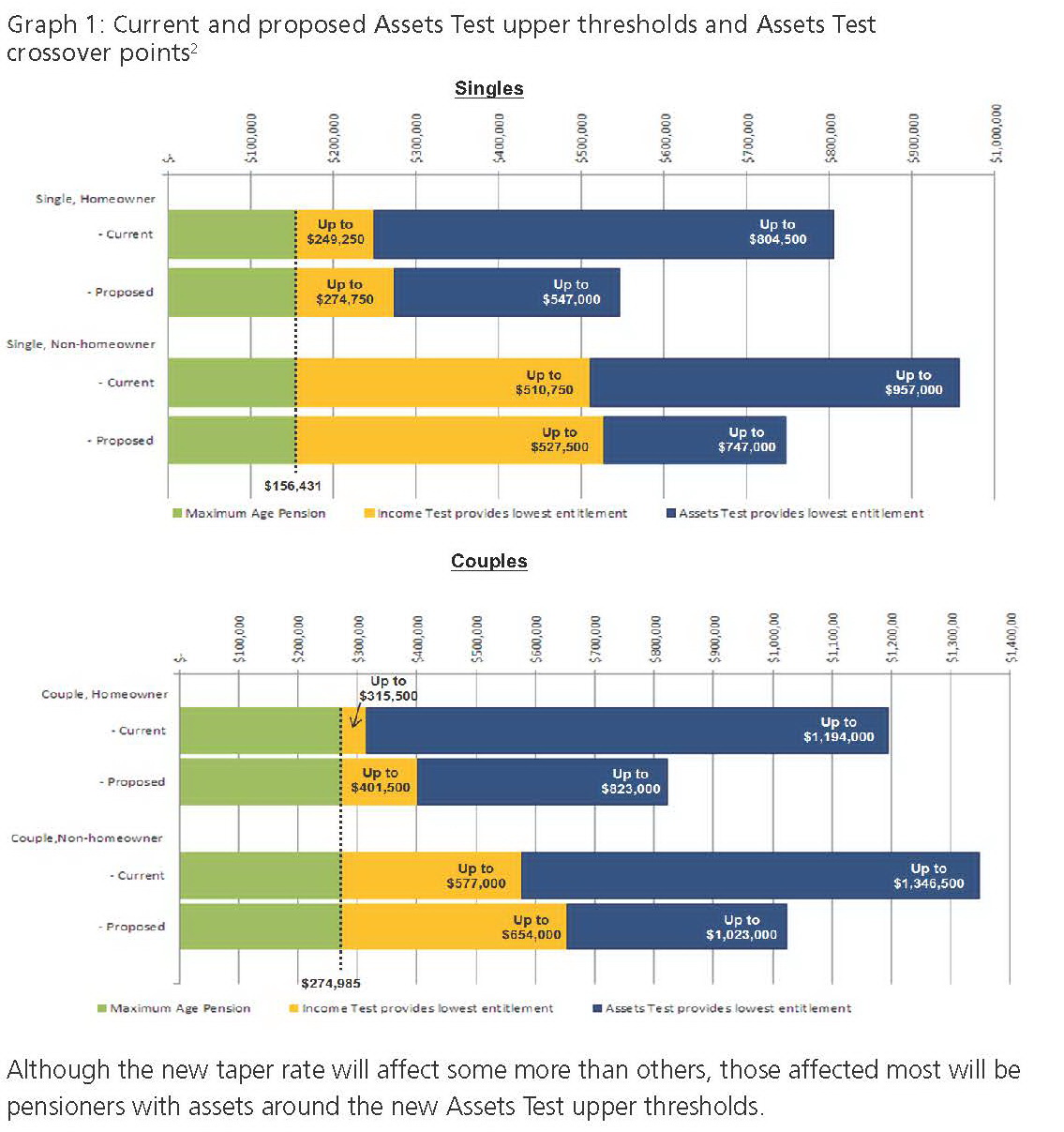

From 1 January 2017, the Government will increase the asset test thresholds and the withdrawal rate at which Age Pensions are reduced once the threshold is exceeded.

The proposed changes to the Age Pension asset test are:

At the same time, the asset taper rate will increase from $1.50 to $3. This means that for every $1,000 of assets you hold over the proposed lower asset test free threshold shown above, your pension rate will reduce by $3 per fortnight.

The assets-test free threshold is the measure for the full Age Pension, that is, when your assets, excluding the family home, are worth less than the threshold. You are then entitled to the full Age Pension, assuming you also meet the Age Pension income test.

At Jason Dawson Financial Planning (JDFP) we have simple methods of explaining how these changes will affect you and your Centrelink Assets Test and we can guide you through the calculations so let us simplify your dealings with Centrelink.