Fractional Property

Fractional Property, as the name states is where you purchase part or a fraction of a whole property. Its a similar concept to Crowd Funding or Syndicated Lending.

While not entirely a new concept there has been a significant development for investment products with in this area of property investing.

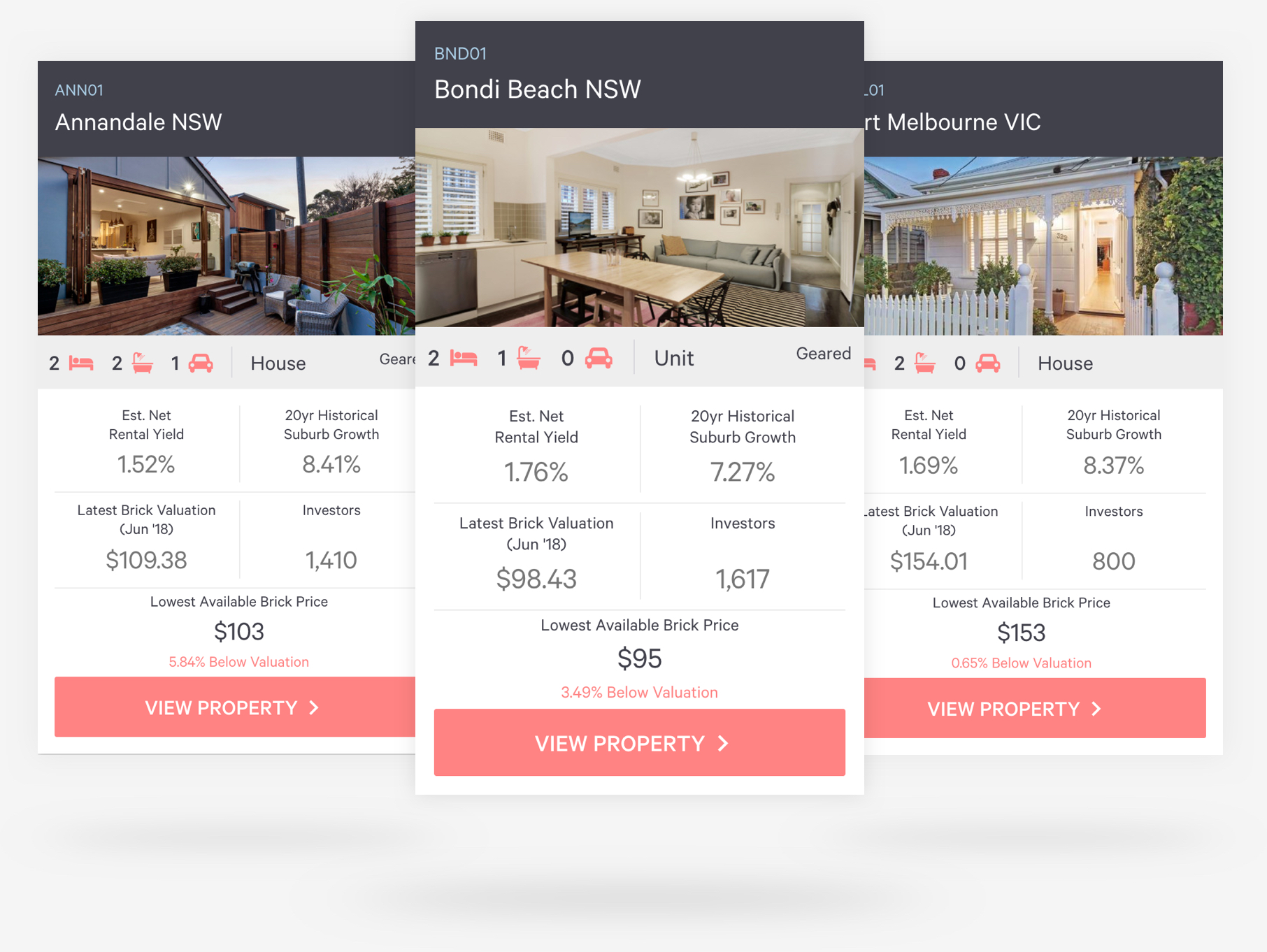

BrickX

BrickX was developed to allow property investors access to multiple properties and different marekts without the large amounts of capital. It invests in residential proeprty and

allows an investor to buy a "brick" in that property and across several others.

Its easier to consider it as a real property portfolio platform, you can achieve diversification in property without the pain associated with rentals. If you would like to discuss more give us a call.

DomaCom

DomaCom, has developed a platform style method for property investors to gain access to physical property they may not originally been able to such as commercial, industrial, office, and interstate residential. Its an innovative and specialised product so please contact us for advice about your property investing needs.

DomaCom was established to help investors secure an investment in the property market without the need to purchase a whole property or necessarily go into debt to do so. The structure chosen to facilitate this makes it an ideal vehicle for any investor, including self-managed superannuation funds (SMSF), where a documented investment strategy is required.

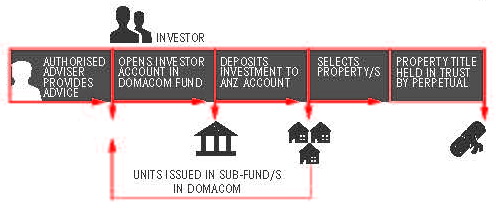

The DomaCom Fund is a managed investment scheme that enables investors to select properties of their choice in which they would like to invest. Via a book build process, investors can commit as much as they want towards the eventual purchase of the properties of their choice together with other like-minded investors. When a book build is complete DomaCom purchases the property, places it in a sub-fund and issues the investors with units according to their contribution.

The DomaCom Fund simulates an investment in property, carrying out the due diligence process of conveyancing, valuation and property inspection, but through a regulated structure enabling multiple people to ‘own’ a share of the property.

A secondary market enables investors who wish to liquidate their holding to sell their units in whole or in part to other investors.

In order to invest in a Sub-Fund an investor must first deposit the amount of their investment in an interest bearing Cash Pool. Once the Investor has chosen which property/ies they wish to invest in, their funds are quarantined until the book build process is complete and the property acquired.

DomaCom has appointed Perpetual Trust Services Ltd to be the Responsible Entity and Perpetual Corporate Trust Ltd as the Custodian for the Fund. Perpetual holds the title for each property.

Ultimately, investors can select any Australian properties to invest in from residential, commercial, rural, retail, industrial and resort/leisure property lists.

Source - DomaCom